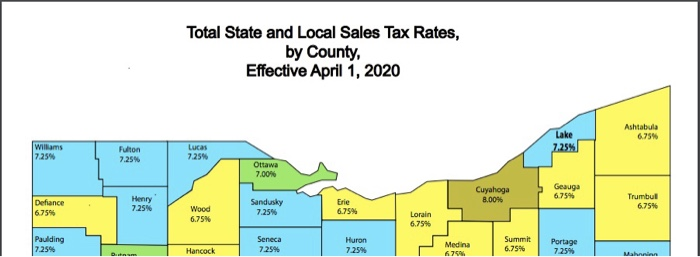

Ohio Sales Tax Rate Map

Ohio Sales Tax Rate Map

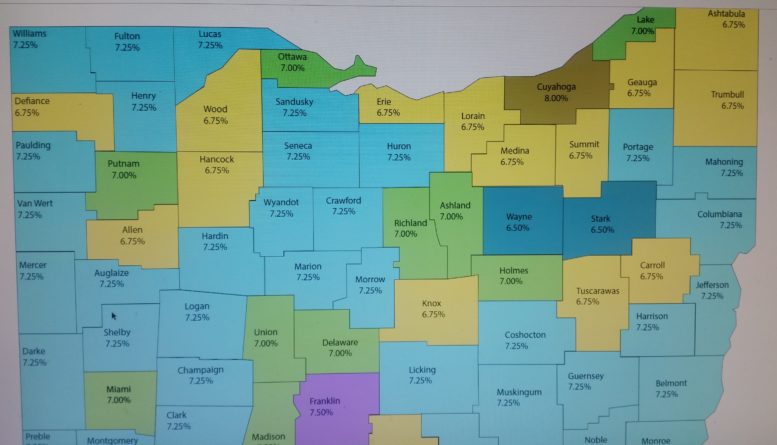

Ohio Sales Tax Rate Map - Other local-level tax rates in the state of Ohio are quite complex compared against local-level tax rates in other states. Ohio has 1424 cities counties and special districts that collect a local sales tax in addition to the Ohio state sales taxClick any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code. The Auglaize County Ohio sales tax is 725 consisting of 575 Ohio state sales tax and 150 Auglaize County local sales taxesThe local sales tax consists of a 150 county sales tax.

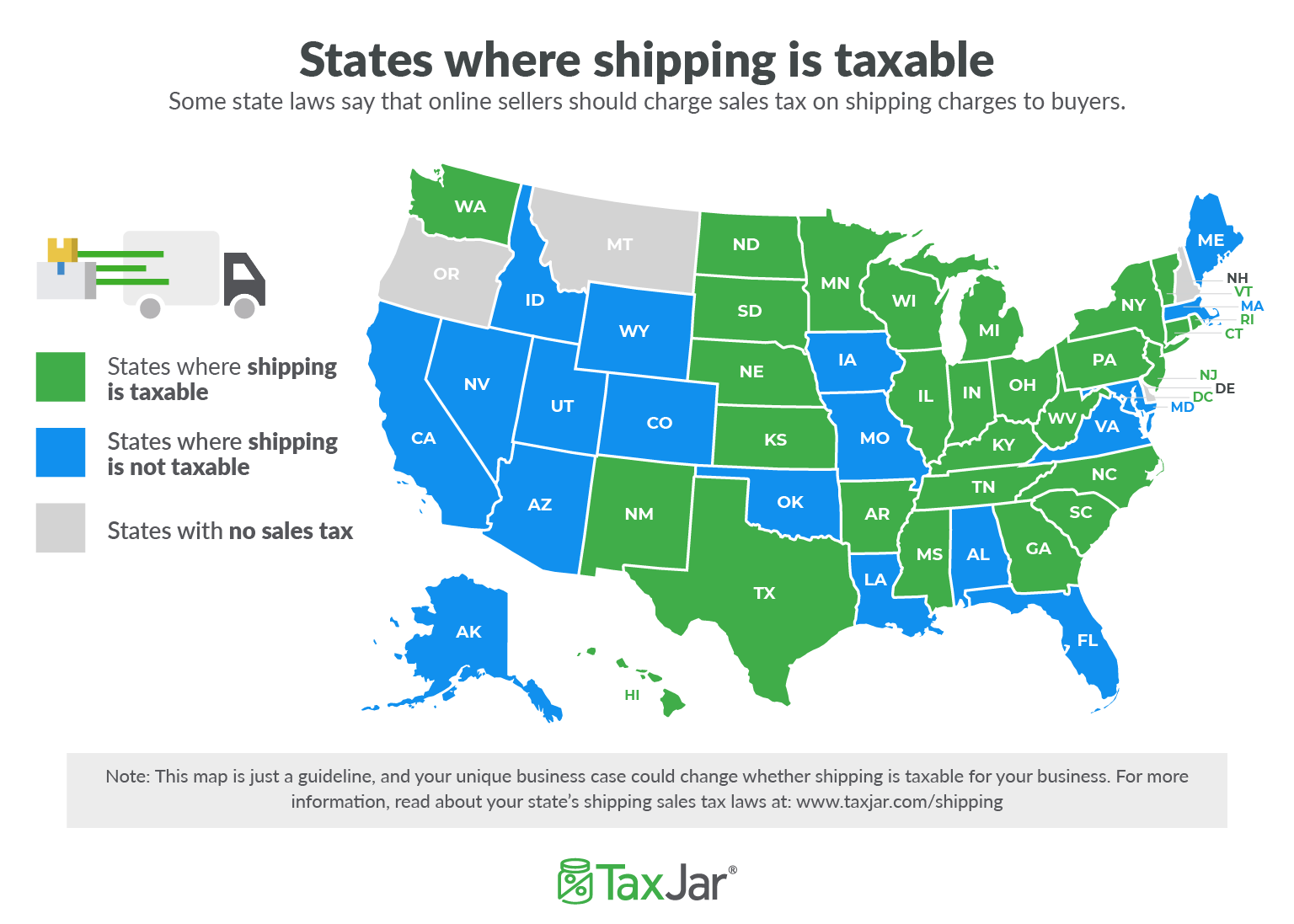

Is Shipping Taxable Taxjar Blog

Is Shipping Taxable Taxjar Blog

The minimum combined 2021 sales tax rate for Summit County Ohio is.

Ohio Sales Tax Rate Map. Counties and cities can charge an additional local sales tax of up to 225 for a maximum possible combined sales tax of 8. For additional information regarding out-of-state sellers or marketplace facilitators please use the links below. The sales and use tax rate for Portage County will be decreasing from 725 to 700 effective January 1 2021 click here to to view additional information on tax rates and changes Changes to Ohios Substantial Nexus Laws.

Groceries are exempt from the Auglaize County and Ohio state sales taxes. The 2018 United States Supreme Court decision in South Dakota v. Ohio has state sales tax of 575 and allows local governments to collect a local option sales tax of up to 225There are a total of 553 local tax jurisdictions across the state collecting an.

Has impacted many state nexus laws and sales tax collection requirements. The Ohio state sales tax rate is currently. Download Ohio Sales Tax Rates By ZIP Code County and City Do you need access to sales tax rates for every ZIP code county and city in Ohio.

This is the total of state and county sales tax rates. The 2018 United States Supreme Court decision in South Dakota v. Ohio has 1424 special sales tax jurisdictions with local sales taxes in addition to the state.

Ohio cities andor municipalities dont have a city sales tax. Depending on local municipalities the total tax rate can be as high as 8. The minimum combined 2021 sales tax rate for Russellville Ohio is.

If you need access to a database of all Ohio local sales tax rates visit the sales tax data page. 53 rows In this interactive sales tax map SalesTaxHandbook has visualized local sales tax rates. To the posted state and county sales tax rate.

The Sharonville sales tax rate is. 1117 rows Ohio has state sales tax of 575 and allows local governments to collect a local. To review the rules in.

This is the total of state and county sales tax rates. The Preble County Sales Tax is collected by the merchant on all qualifying sales made within Preble County. The Summit County sales tax rate is.

The Ohio OH state sales tax rate is currently 575. This is the total of state county and city sales tax rates. The Russellville sales tax rate is.

- The Finder This online tool can help determine the sales tax rate in effect for any address in Ohio. To review the rules in. The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71.

The sales tax rates database is available for either a one-time fee or a discounted subscription. The Saint Marys Ohio sales tax rate of 725 applies in the zip code 45885. Has impacted many state nexus laws.

The County sales tax rate is. The sales and use tax rate for Portage County will be decreasing from 725 to 700 effective January 1 2021 - Map of current sales tax rates. Has impacted many state nexus laws.

This interactive sales tax map map of Ohio shows how local sales tax rates vary across Ohios 88 counties. Delawares COTA rate covers the portions of the Cities of Columbus and Westerville located in Delaware County. The 2018 United States Supreme Court decision in South Dakota v.

Remember that zip code boundaries dont always match up with political boundaries like Saint Marys or Auglaize County so you shouldnt always rely on something as imprecise as zip codes to determine the sales tax rates at. The Auglaize County Sales Tax is collected by the merchant on all qualifying sales made within Auglaize County. Groceries and prescription drugs are exempt from the Ohio sales tax.

There are approximately 10830 people living in the Saint Marys area. Licking Countys COTA rate covers the portion of the City of Reynoldsburg located in Licking County and Unions COTA. There is no city sale tax for the Ohio citiesThe Ohios tax rate may change depending of the type of purchase.

The Cuyahoga County sales tax rate is. The minimum combined 2021 sales tax rate for Sharonville Ohio is. The County sales tax rate is.

The Ohio sales tax rate is currently. Has impacted many state nexus laws and sales tax collection requirements. Groceries are exempt from the Preble County and Ohio state sales taxes.

The 2018 United States Supreme Court decision in South Dakota v. The Ohio state sales tax rate is currently. Fairfields COTA rate covers the portions of the Cities of Columbus and Reynoldsburg in Fairfield County.

The Ohio sales tax rate is currently. The state general sales tax rate of Ohio is 575. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

This is the total of state county and city sales tax rates. Every 2021 combined rates mentioned above are the results of Ohio state rate 575 the county rate 075 to 225 and in some case special rate 0 to 05. Click on any county for detailed sales tax rates or see a full list of Ohio counties here.

The Preble County Ohio sales tax is 725 consisting of 575 Ohio state sales tax and 150 Preble County local sales taxesThe local sales tax consists of a 150 county sales tax. The minimum combined 2021 sales tax rate for Cuyahoga County Ohio is.

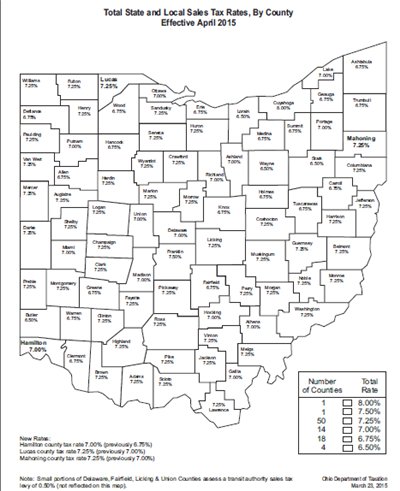

State And Local Sales Tax Information

State And Local Sales Tax Information

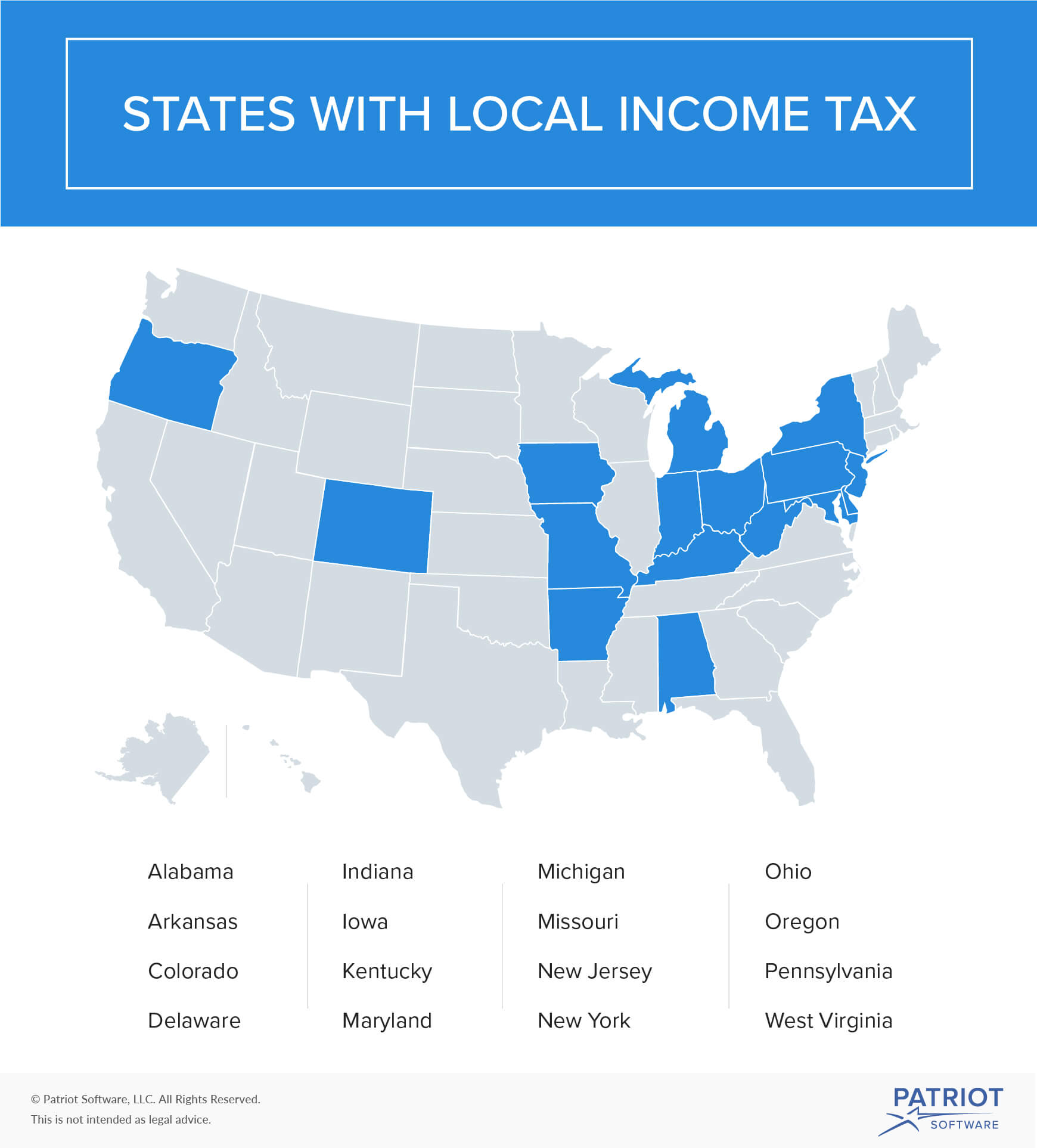

Local Income Taxes In 2019 Local Income Tax City County Level

Local Income Taxes In 2019 Local Income Tax City County Level

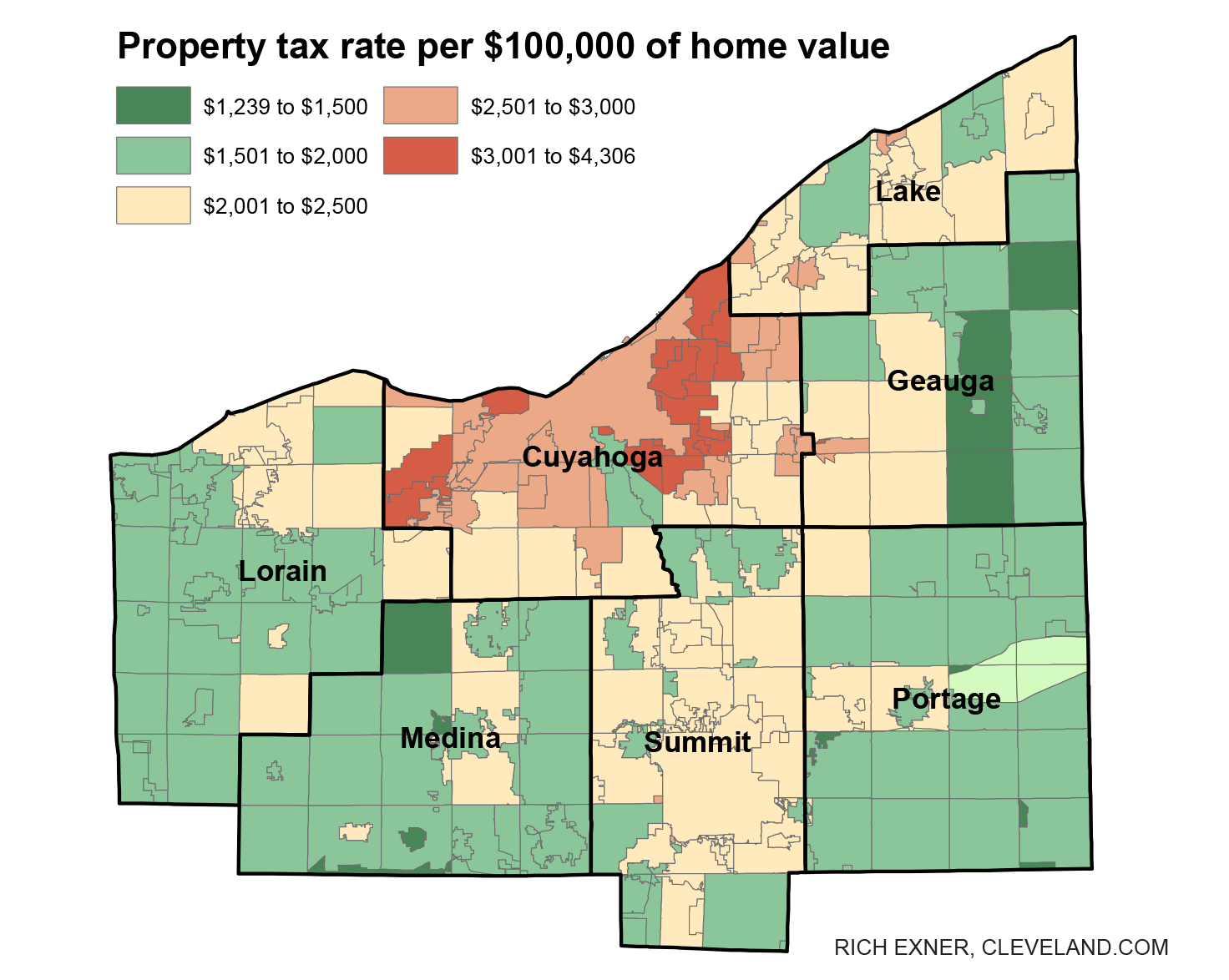

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Ohio County Tax Rate Map Fill Online Printable Fillable Blank Pdffiller

Ohio County Tax Rate Map Fill Online Printable Fillable Blank Pdffiller

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

State Sales Tax Rates 2021 Avalara

Compare Property Tax Rates In Greater Cleveland And Akron Many Of Highest Rates Statewide In Cuyahoga County Cleveland Com

Compare Property Tax Rates In Greater Cleveland And Akron Many Of Highest Rates Statewide In Cuyahoga County Cleveland Com

Sales Tax Tuesday Ohio Insightfulaccountant Com

Sales Tax Tuesday Ohio Insightfulaccountant Com

Property Tax Rates Across The State

Lo 23 2 Research 31 Cuyahoga County Ohio Has A Chegg Com

Lo 23 2 Research 31 Cuyahoga County Ohio Has A Chegg Com

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

State And Local Sales Tax Rates 2018 Tax Foundation

State And Local Sales Tax Rates 2018 Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Sales Tax Rates Sales Tax Institute

State Sales Tax Rates Sales Tax Institute

Property Tax Rates Across The State

How To Charge The Correct Sales Tax Rates In Ohio Unlimited Media

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

State By State Guide To Taxes On Middle Class Families

State By State Guide To Taxes On Middle Class Families

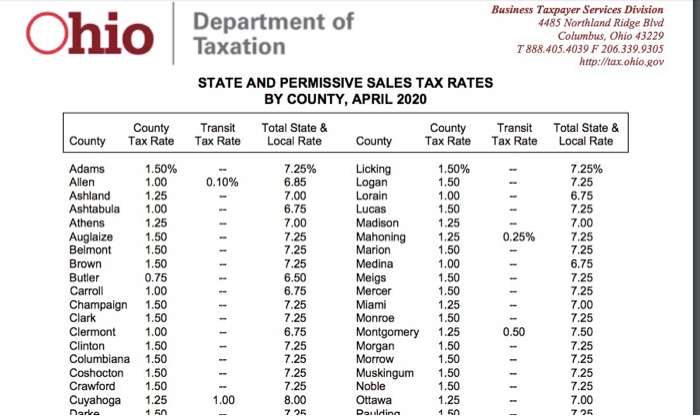

Sales Tax Rate Changes April 2020

Sales Tax Rate Changes April 2020

U S Property Taxes Levied On Single Family Homes In 2018 Increased 4 Percent To More Than 304 Billion Attom

U S Property Taxes Levied On Single Family Homes In 2018 Increased 4 Percent To More Than 304 Billion Attom

What Is Local Income Tax Types States With Local Income Tax More

What Is Local Income Tax Types States With Local Income Tax More

Wood County Likes Its Status On Low Sales Tax Island Bg Independent News

Wood County Likes Its Status On Low Sales Tax Island Bg Independent News

Logan County Ohio Sales Tax Rate Rating Walls

Logan County Ohio Sales Tax Rate Rating Walls

State Corporate Income Tax Rates And Brackets For 2020

State Corporate Income Tax Rates And Brackets For 2020

Ohio Sales Tax Map And Rates The Salt Report

2019 State Individual Income Tax Rates And Brackets Tax Foundation

2019 State Individual Income Tax Rates And Brackets Tax Foundation

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

States With Highest And Lowest Sales Tax Rates

States With Highest And Lowest Sales Tax Rates

Breaking Sales Tax Rates Down By Jurisdiction

Breaking Sales Tax Rates Down By Jurisdiction

Ohio Sales And Use Tax Rates Lookup By City Zip2tax Llc

Ohio Sales And Use Tax Rates Lookup By City Zip2tax Llc

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gctungwvw6 R00h6x4zyttvcjixiq6b0asnvftxtqfftuqn0ot I Usqp Cau

Which States Require Sales Tax On Clothing Taxjar Blog

Which States Require Sales Tax On Clothing Taxjar Blog

The Best States To Retire For Taxes Smartasset

The Best States To Retire For Taxes Smartasset

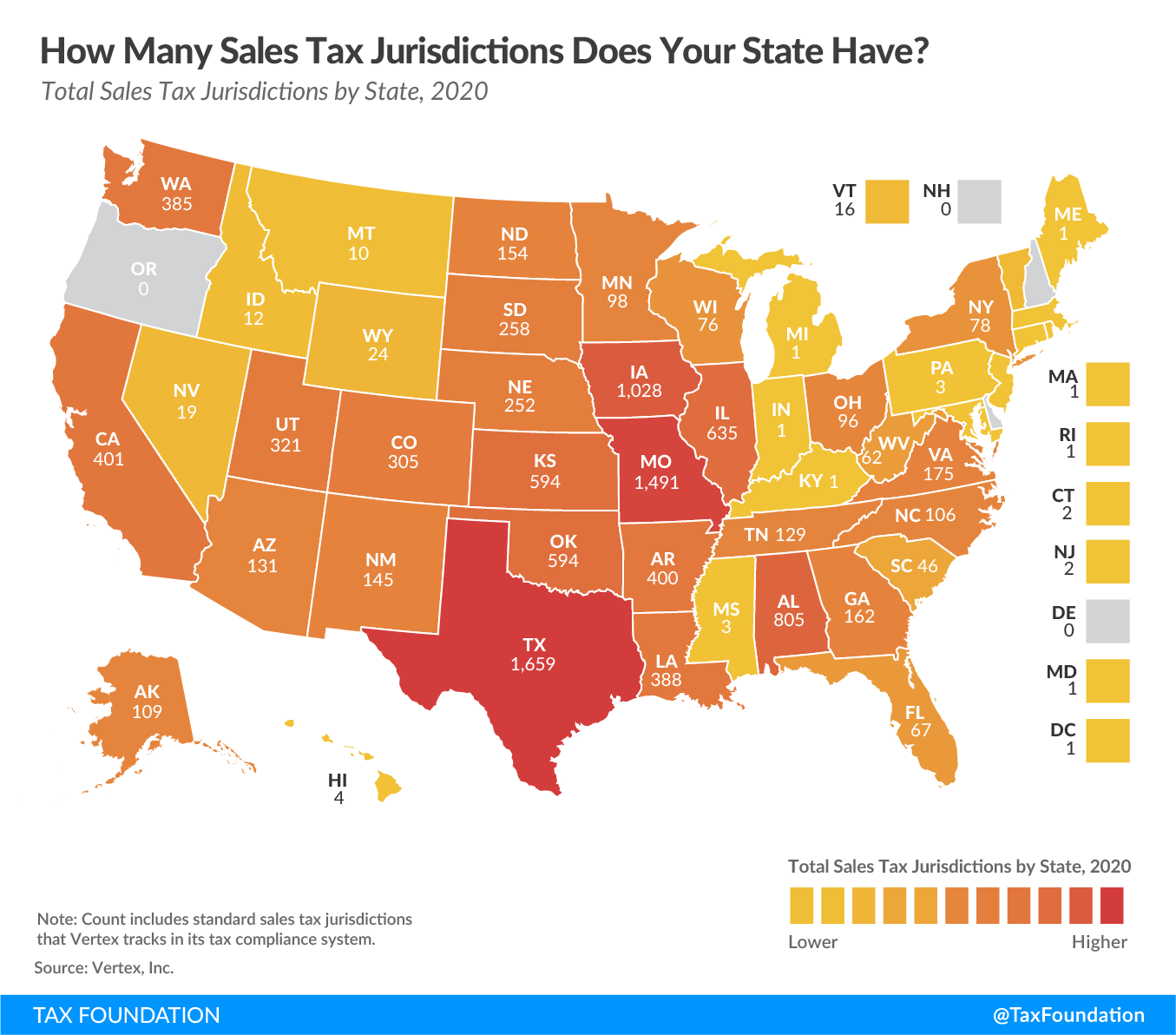

Sales Tax Jurisdictions By State 2020 Tax Foundation

Sales Tax Jurisdictions By State 2020 Tax Foundation

State Sales Tax Rates Sales Tax Institute

State Sales Tax Rates Sales Tax Institute

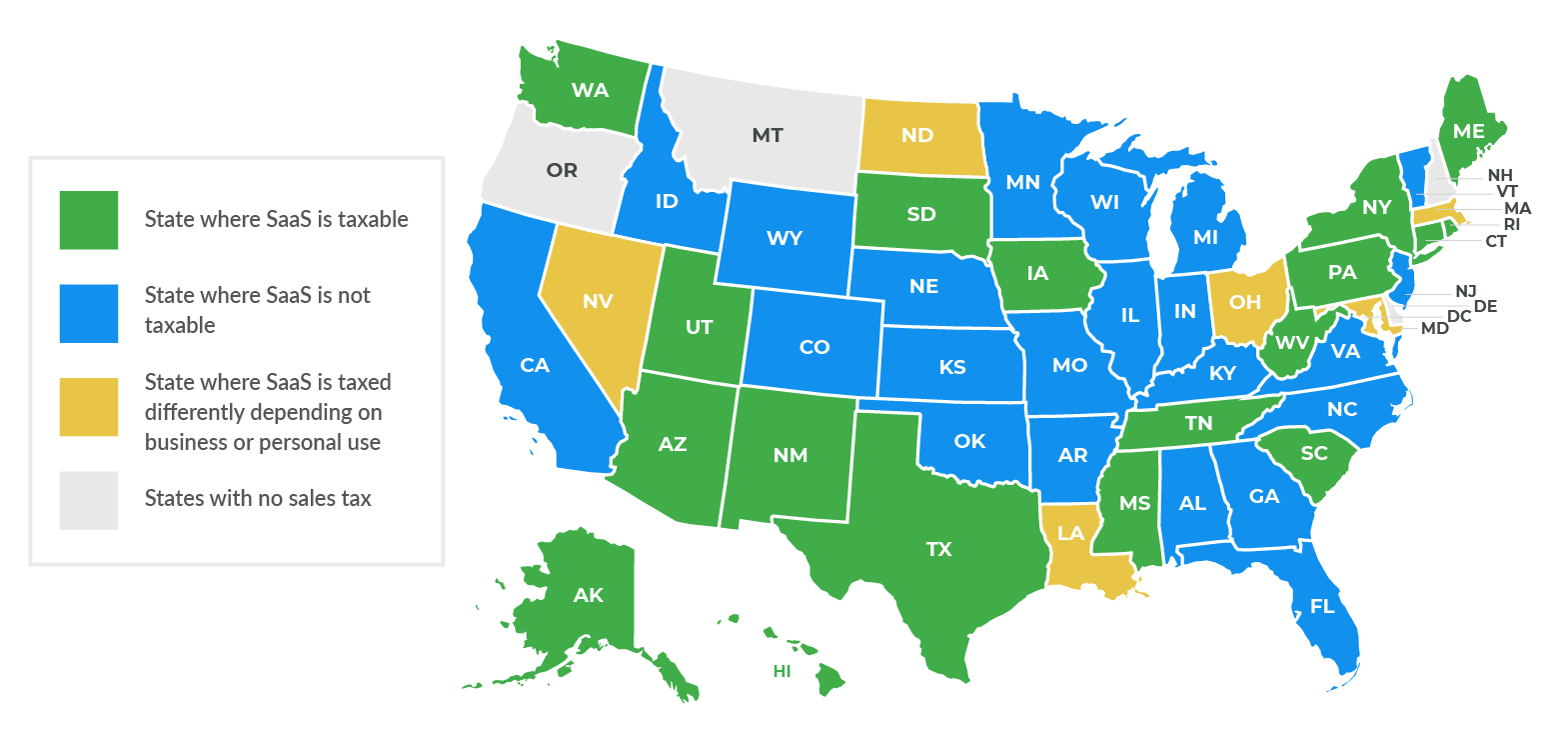

Sales Tax By State Is Saas Taxable Taxjar Blog

Sales Tax By State Is Saas Taxable Taxjar Blog

Logan County Ohio Sales Tax Rate Rating Walls

Logan County Ohio Sales Tax Rate Rating Walls

Lo 23 2 Research 31 Cuyahoga County Ohio Has A Chegg Com

Lo 23 2 Research 31 Cuyahoga County Ohio Has A Chegg Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

9 Graphical Things To Know About Gov Kasich S Ohio Budget Proposal Cleveland Com

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcr3drt16bs2lupst6neqagra J8q76iionvmcho4zd2regfiybb Usqp Cau

States With The Highest And Lowest Sales Taxes

States With The Highest And Lowest Sales Taxes

Sales Taxes In The United States Wikipedia

Sales Taxes In The United States Wikipedia

Post a Comment for "Ohio Sales Tax Rate Map"